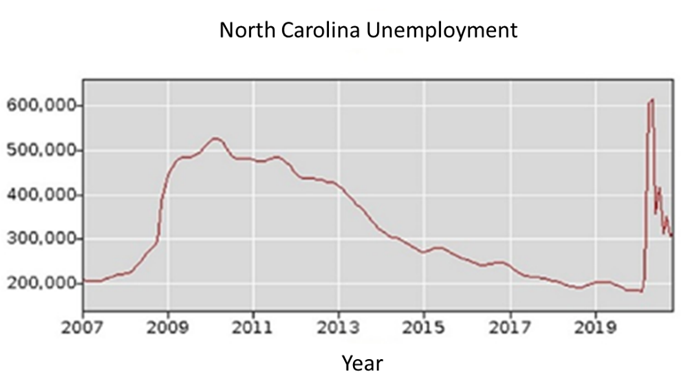

The current narrative around the U.S. labor market is a mixed bag. On the one hand, many companies are struggling to find enough workers to return to a semblance of normal operations. On the other, 8 million fewer Americans were employed in April 2021 as compared to February 2020. We asked three experts from the […].

The current narrative around the U.S. labor market is a mixed bag. On the one hand, many companies are struggling to find enough workers to return to a semblance of normal operations. On the other, 8 million fewer Americans were employed in April 2021 as compared to February 2020. We asked three experts from the University of North Carolina at Chapel Hill — Christian Lundblad, Director of Research, Kenan Institute of Private Enterprise and Richard "Dick" Levin Distinguished Professor of Finance, Area Chair of Finance and Associate Dean of the Ph.D. program, Kenan-Flagler Business School; Luca Flabbi, Associate Professor of Economics; and Paige Ouimet, Professor of Finance, Kenan-Flagler Business School — to weigh in on the critical issues behind this dichotomy.

Q: Do you think the United States is in the midst of a labor shortage?

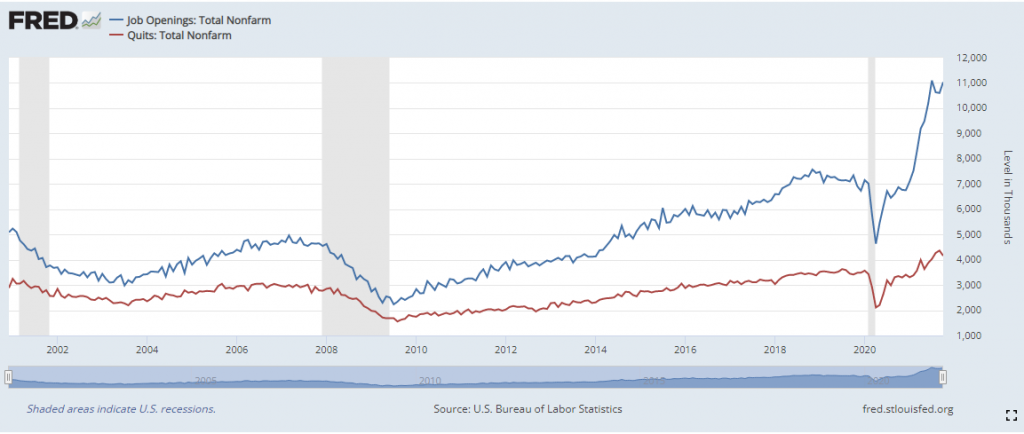

PROFESSOR PAIGE OUIMET: I think it’s an oversimplification to think of the labor market as one monolithic entity. Its current characteristics really highlight this point. There are significant labor shortages, with the number of job openings measured by the Bureau of Labor Statistics reaching an all-time high of 8.1 million in March. But at the same time, there are 9.8 million unemployed Americans currently looking for work.

How do we reconcile these two statistics? I think much of what we are seeing is growing pains from a rapidly recovering economy. For example, the accommodation and food services industry saw nearly half of its jobs disappear in early 2020. Many of those workers have since found work. So as firms in this industry quickly try to rehire as demand is increasing, they’ll have to find new workers. I think what we’re seeing now is a temporary bottleneck as customers return to some sectors faster than those sectors can add employees.

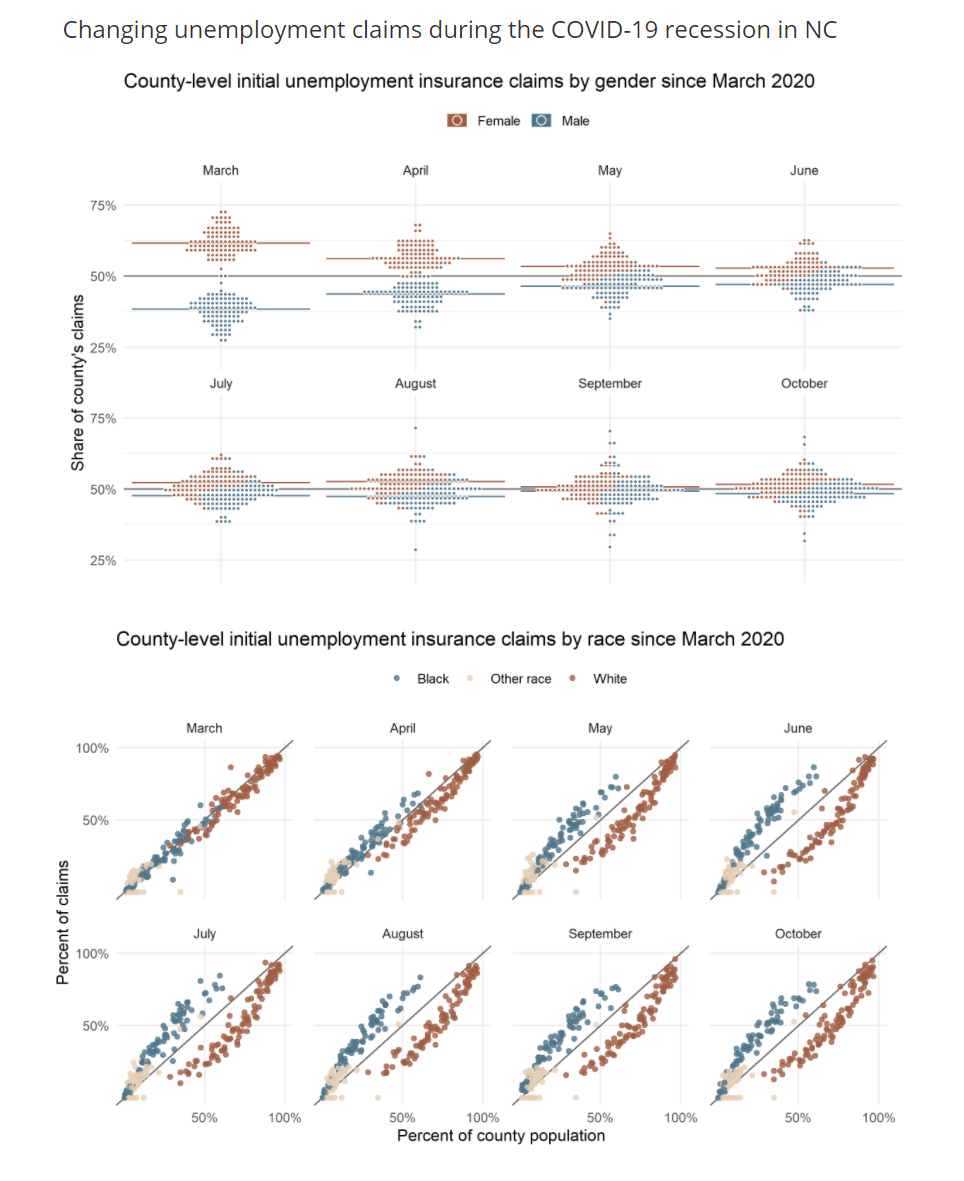

PROFESSOR CHRISTIAN LUNDBLAD: We can certainly point to industries and regions that remain economically weak and where excess capacity is undeniably linked to sidelined laborers. Further, the extent to which many children around the country remain at home in remote learning situations has forced some workers, disproportionately women, to exit the labor force all together. Representing a significant pool of excess labor, they and other sidelined workers would presumably like to return to work when feasible. Finally, unemployment benefits and other government support mechanisms have been generous; the unintended consequence is that a subset of workers may delay returning to work until benefits roll off, temporarily limiting supply. Although it’s hard to quantify these and other competing effects, it‘s reasonable to assume that they’re not permanent. Collectively, the labor market situation is nuanced.

What’s more complicated is the growing wedge between those workers with skills in high demand and others. It’s important to characterize the pre-COVID labor market as highly bifurcated; even then, there were significant shortages of certain skills, while other skills were plentiful. Companies often expressed frustration over the rapidly growing costs of certain scarce laborers. So, in a way, the question is whether there is still something particular about the pandemic shutdown that remains the dominant weight on labor markets. Or, are we witnessing an acceleration of the economic reallocations that were already driving this earlier wage divergence? The pandemic experience has likely pressed fast-forward on that story, and business and workers will need to adjust. In pockets that are critically linked to many businesses’ most interesting growth opportunities, there is a shortage of skills, and the associated labor costs were already high and continue to rise.

PROFESSOR LUCA FLABBI: I don’t think we’re in a midst of a labor shortage. Instead, I think employers are finding it difficult to find workers willing to accept their job offers at the speed that they would like. Two main factors that technically have nothing to do with labor shortages but are contributing to this dynamic: wage levels and uncertainty. Two additional factors may also play a role in generating actual labor shortages in specific sectors: labor reallocation across industries and the female labor supply.

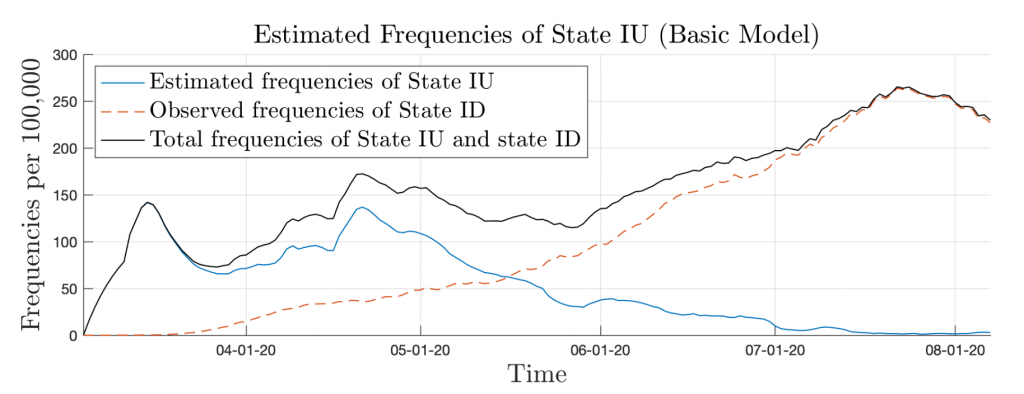

With respect to the first two factors, as with any other good, when demand increases, prices should adjust upward if trades are to be concluded successfully. We’re in the middle of a large increase in labor demand, and therefore wage levels should increase. So it’s not surprising that some employers are finding it extremely difficult to find workers at pre-pandemic wage levels. That’s not shortage, it’s a lack of price adjustment. But that’s not the entire story, because we’re starting to see wage increases. So the second factor, uncertainty, may be playing a role. The pandemic is fading, but there is still a significant proportion of people who are not vaccinated, and who may never be. As a result, future pandemic flare-ups in particular regions, industries or occupations are not completely out of the question. Given this lingering uncertainty, workers may wait before accepting a job. They may think that things will be better in the future, and if they wait a little longer, they’ll get a better job. Or they may think things will be worse again in the future in a particular sector (e.g., hospitality or health), and they are therefore looking for a job in other sectors.

This last point introduces the first of the two additional factors: labor reallocation and the female labor supply. Suppose you were working in the hospitality industry before the pandemic. Given your expectations about career and job stability, you were happy to do a given job at a certain wage. Post-pandemic, you’ve learned that jobs in that industry are less stable than you thought they were, so you decide to look for a job in another sector. Such reallocations may be generating genuine shortages in specific industries; even if firms were to pay the maximum wage they can without incurring significant losses (technically, the worker's marginal productivity), there are not enough workers willing to work at that job. At the moment, it is not clear how quantitatively important this labor reallocation is.

With respect to the second factor, female labor supply, overwhelming evidence shows that women are still the main provider of childcare within the family. With schools and childcare facilities closed, women have been forced to spend more time caring for children and less time in the workforce. Some have been forced to leave the labor force entirely. As of today, it’s still not clear if schools and childcare centers will reopen full-time for the entire year. Therefore, many women are reluctant to reenter the labor market, reducing the labor supply overall, but especially in sectors with a predominately female workforce.

Q: What needs to happen for the labor market to fully recover from the pandemic?

OUIMET: One important step is for the employment-to-population ratio, the fraction of working-age individuals in America who are currently employed, to return to more historic levels. During the pandemic, we saw a large number of Americans withdraw from the labor market due to health worries, caregiving responsibilities or because they were too discouraged to find work. These people will not be counted as part of the unemployment rate because they are not actively looking for work. For the labor market to fully recover, we need millions of these American who left the workforce during the COVID pandemic to reenter. What conditions are required for this to happen?

First, workers need to feel safe going to work. Vaccine availability is a game-changer, but as mask requirements are dropped, some workers will be hesitant to return to public spaces. Second, schools need to open and parents must feel safe sending their kids back to school. A large number of childcare centers closed during the pandemic due to low demand. Now they’re trying to reopen and hire, but are having trouble keeping pace with the sudden surge in demand. If families can’t find childcare, this will also limit labor force participation rates. Finally, we need to be patient. With 8.1 million job postings —the highest level ever measured — there are great signs for the economy, but we also have to understand that the labor market can’t adjust overnight. There’s a lot of reallocation involved, and this will take time.

LUNDBLAD: Leaving aside the pervasive skill mismatch, the underlying drivers of the short-term impediments to full recovery need to be addressed.

First, nonessential economic activity (the willingness of a customer to walk through a shop door, sit in a crowded theater, book a cruise, and so on) needs to bounce back. This will not happen until Americans feel comfortable taking on these activities. So no policy is more important than an effective vaccine distribution and, critically, uptake. Americans need to get vaccinated.

Second, we need kids to get back in school. While we have long argued for the economic benefits of education on future productivity, we’ve learned that there is a perhaps far more direct link between economic activity and school; if kids are out of school, we really can’t work!

Third, we need to find a way to adjust government support in a way that continues to help the subset of Americans who will still struggle as we navigate through next steps, without dis-incentivizing their return to work.

Finally, on the international stage, our global trading partners are largely in far worse shape than are we. This is patricianly true in the emerging world, where economic activity will be constrained for some time as the challenges of the virus remain front and center. The upsetting pictures from India only reinforce the idea that a global economic recovery cannot happen anytime soon. At a very pragmatic level, U.S. supply chain, export/import and financial considerations are inextricably tied to the wellbeing of our partners. Global vaccine distribution is key.

FLABBI: Three things need to happen before we reach a full recovery of the labor market in particular and the economy in general. First, wages should adjust to the new post-pandemic labor market conditions. Second, the ongoing uncertainty should be resolved. Are we out of this pandemic for sure? Could a similar pandemic reappear in the short-to-medium term? Third, the labor reallocation that seems to be taking place needs to settle. This process may take some time, as workers who decide to change their occupation may need to acquire new skills.

Q: Are there other economic conditions we should watch that could disrupt the labor market recovery?

OUIMET: We‘re currently seeing bottlenecks throughout the economy, not just in hiring. And these supply shortages, if they persist too long, could slow the speed at which firms can grow and, therefore, hire. I expect these will keep popping up, especially as COVID-19 continues to surge internationally.

LUNDBLAD: The most obvious concern is related to the virus itself. The real wild card is a viral mutation that renders our vaccines significantly less effective. Although we’ve learned so much about navigating this new world, such a development would endanger much of our economic progress.

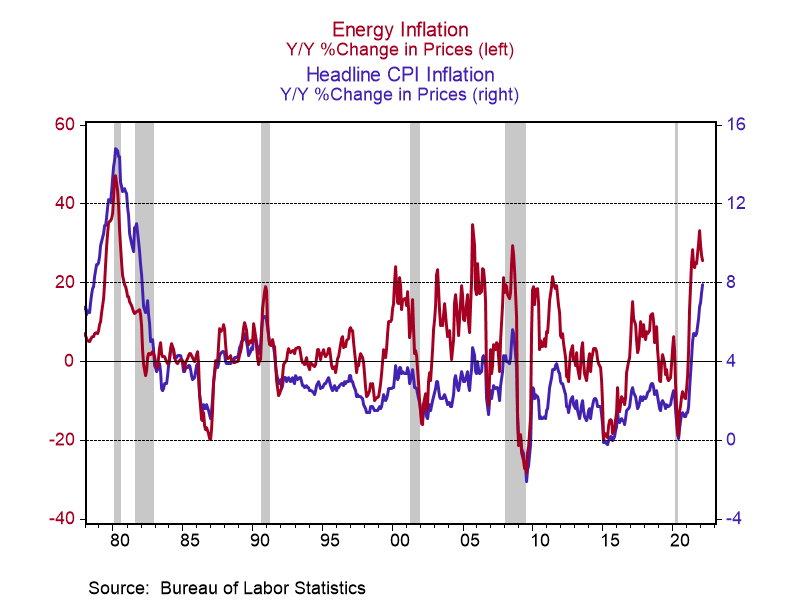

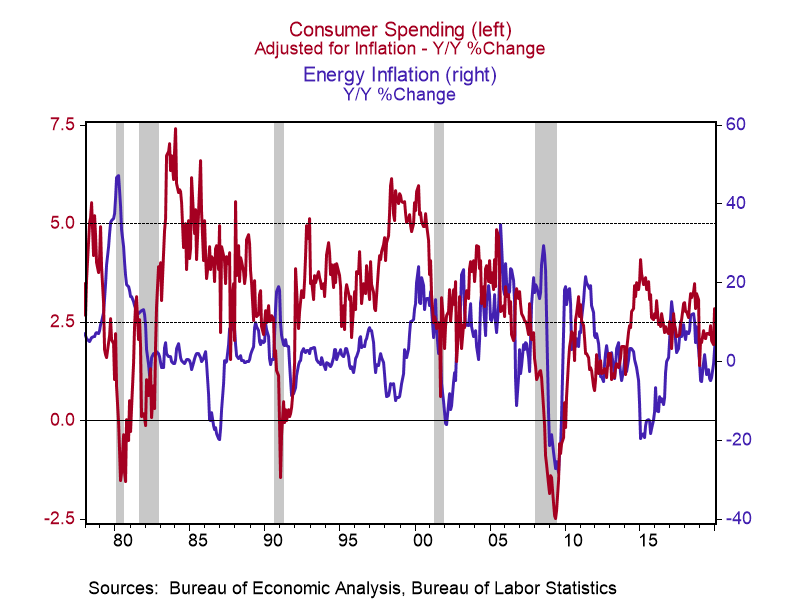

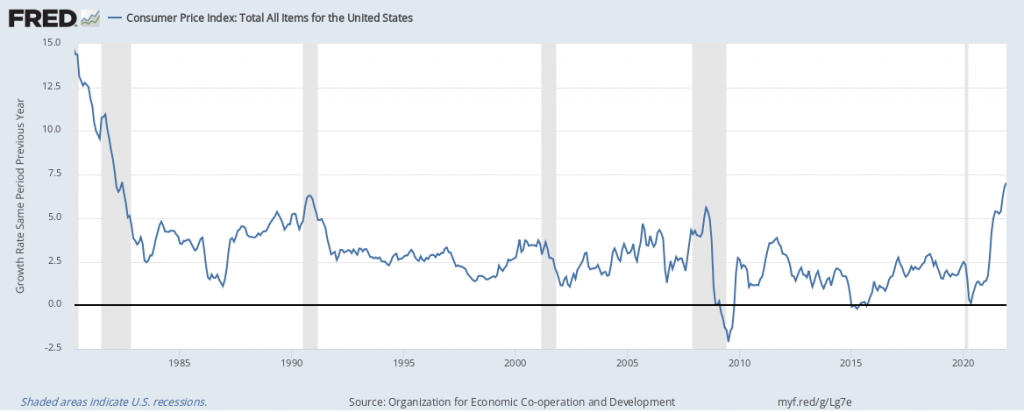

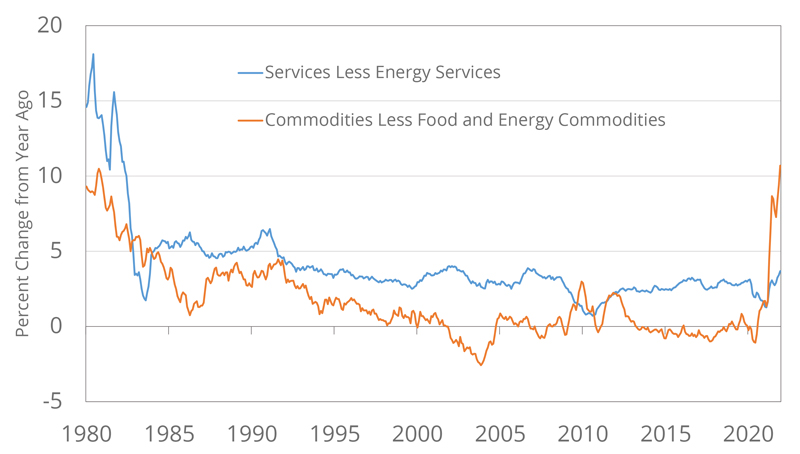

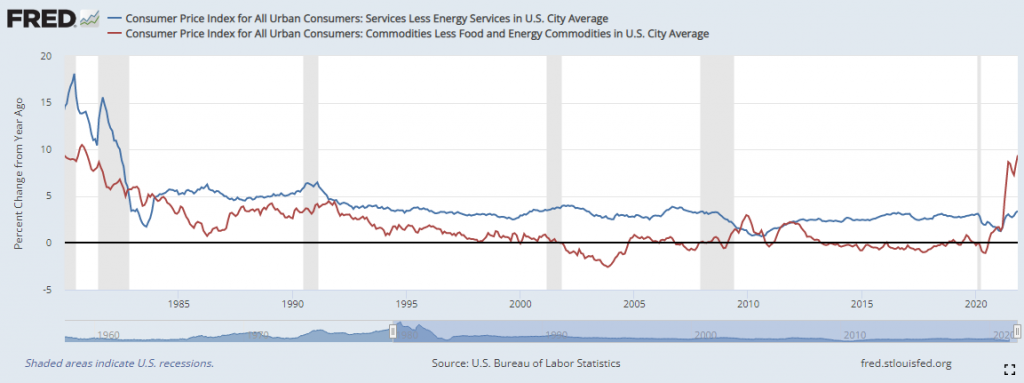

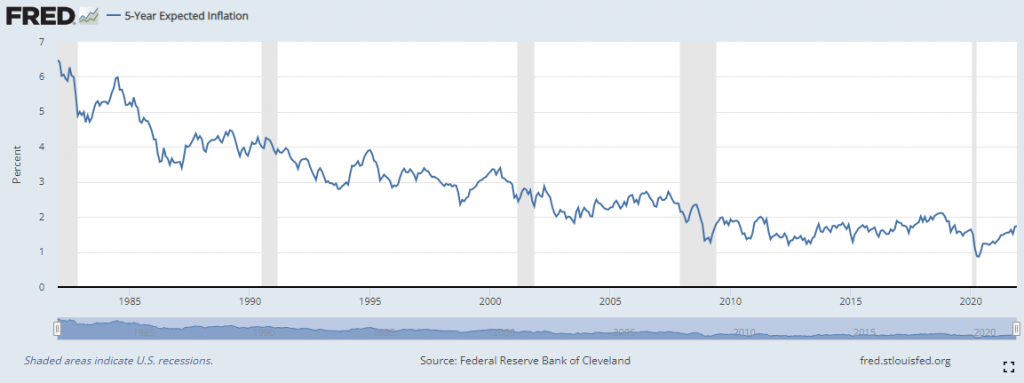

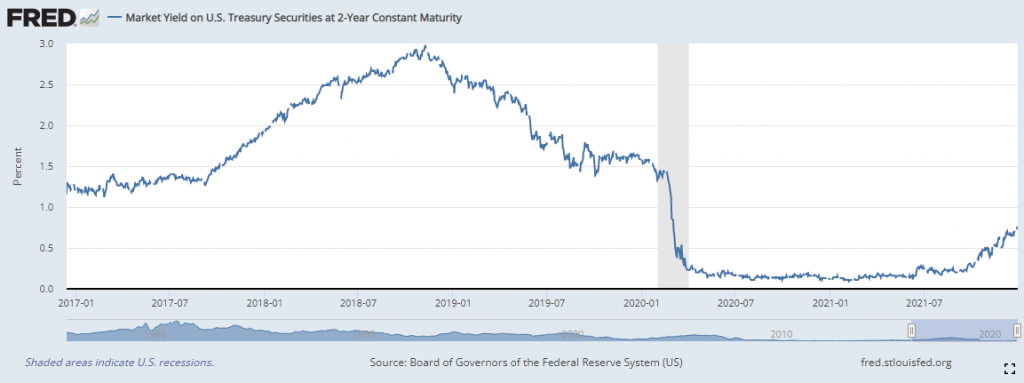

Aside from viral developments, there’s also a brewing risk of inflation. The price of many goods is already rising (the recent inflation print was the largest we’ve seen in decades), but many economists, including the Fed, view this development as transitory, with certain price increases reflecting, for example, temporary supply chain disruptions. I’m skeptical — there is a several-trillion-dollar wall of savings, ballooned by federal stimulus, that’s ready to go; this creates a real risk of demand-induced inflationary pressures. While we’re admittedly far from these pressures manifesting in wages themselves, I fear that sustained inflation is coming, and the Federal Reserve may very well be caught behind the curve. If they have to significantly increase interest rates to manage inflationary expectations, the labor market will not go unscathed.

FLABBI: More than other economic conditions, the coordination of actions and expectations in order to accommodate the processes I’ve already mentioned is something we have to watch carefully. This is always true after major shocks hit the economy. In the readjustment phase, economic agents may overreact, magnifying uncertainty and slowing down recovery. For example, some employers may wait too long to increase wages, losing valuable business opportunities in the meantime. Others may increase wages by too much, forcing themselves to increase prices too steeply, possibly generating inflation. As another example, childcare services and schools may take too long to reopen, hindering the reentry of women into the labor market.

Q: What else should we be paying attention to with regard to the labor market?

OUIMET: The one thing I’m watching closely is wage growth. To the extent that we’re facing a labor shortage, then we should see sustained wage increases. Right now, we’re seeing wage increases in the leisure and hospitality industry that would annualize to about 16%. This is consistent with the concerns raised by businesses in that industry about hiring difficulties. I don’t expect to see similar wage growth in other sectors of the economy; however, if we do, that’s evidence of more significant labor shortages. And of course it’s important to follow the employment-to-population ratio: are we seeing more Americans reenter the workforce?

Q: What is one policy that the federal government either should or should not adopt in order to support job growth?

OUIMET: I’m less focused on actions to support aggregate job growth. There will be bumps along the way, but I’m optimistic we’ll continue to see aggregate job growth through 2021. However, I am concerned about the inequities in our labor market that were laid bare during the pandemic. During COVID, high-skilled workers were mostly protected from job losses and often received wage gains. Large rewards for high-skilled workers have long been a feature of our labor market and encourage innovation and risk-taking, leading to economy-wide productivity gains. But we need to ensure that workers and families on the other end of the skill distribution can still meet their basic needs in this labor market. One policy on which I’m very bullish is the child tax credit that was passed as part of the American Rescue Plan aid package. I would like to see this become permanent policy.

LUNDBLAD: We need to get kids back in school. That’s perhaps less a federal issue than a state and local issue, but governments need to get kids back into the classroom. Undeniably, part of our labor market disruption remains linked to a sizable fraction of parents still — more than a year later — struggling to juggle work, school and everything else. The labor market will remain jumbled until we figure this out. Next to vaccine distribution, there’s no more important job for local officials right now, and they need to find the courage to act.

The most important reason to take action stems from the fear that this educational disconnect will be far more consequential in its long-run implications, with a generation of kids who suffer poorer educational and labor market outcomes over their entire lifetimes. The aggregate economic implications of such a scenario would be staggering. We know that our children are facing impossible levels of anxiety and depression, and that they’re falling behind in their schoolwork. We need to foster a less contentious environment in which we can take intelligent risks and conduct policy experiments that allow us to figure out what does and doesn’t work.

FLABBI: Many of the adjustments taking place in the labor market and the economy will likely be solved through standard market mechanisms once the uncertainty is resolved. But there are two important areas where I think the government has an important role to play.

First, this shock had nothing to do with economic fundamentals; it was a health crisis, so any policy that can make the health sector more resilient to shocks will be helpful. Any such policy will decrease uncertainty because economic agents will know that even if another pandemic hits us in the short- or medium-term, we’ll be better prepared.

Second, any policy favoring the reentry of women into the labor force will be beneficial. To that end, at the top of the list is the provision of child care services; for younger ages, these services are similar to public goods, but in the U.S. have not so far been considered as such — just compare the amount of public money used to subsidize the public school system with the one devoted to the care of preschoolers.