Should Cryptocurrency “Pump-and-Dump” Schemes be Regulated?

Executive Summary

- The tremendous growth in cryptocurrency trading has included frequent pump-and-dump (P&D) schemes, a form of price manipulation that is currently unregulated in this market.

- New research reveals that cryptocurrency P&Ds lead to price and volume inflations that last mere minutes, creating volatility that only benefits traders who have advance notice of the scheme.

- A P&D ban instituted by a major cryptocurrency exchange led to increased token volumes and prices compared to similar tokens traded on exchanges without P&D bans. This finding indicates that P&Ds reduce investors’ willingness to invest in the cryptocurrency market.

What are cryptocurrencies and why are they important?

Significant wealth is transferred from those who don’t know about the P&D to those with insider knowledge.

Bitcoin and other cryptocurrencies are created and managed with sophisticated encryption techniques. Rather than being controlled by a central bank like traditional currencies, these virtual assets have no overseeing authority. Their decentralized control is accomplished through a record-keeping technology known as blockchain that records and distributes digital transactions.

Technology startups have recently begun creating new cryptocurrencies to raise capital. This happens through an initial coin offering, during which the startup creates a token and offers it in exchange for established cryptocurrencies such as Bitcoin, or legal tenders such as U.S. dollars. These new cryptocurrencies can then be traded in online exchanges that operate 24 hours a day, seven days a week.

In 2018, initial coin offerings from 2,000 blockchain startups raised nearly $11.4 billion. The sudden growth in this market has raised both excitement and concern about potential exploitation and fraud.

What is a cryptocurrency pump-and-dump scheme?

Pump-and-dump (P&D) schemes are a type of price manipulation in which an asset’s price is artificially inflated so that a cheaply purchased asset can be sold at a higher price. Once dumped, prices quickly fall, and investors lose money.

In the cryptocurrency market, P&Ds are organized through pump groups, who communicate through heavily encrypted messaging platforms. Investors learn about pump groups through advertisements on social media.

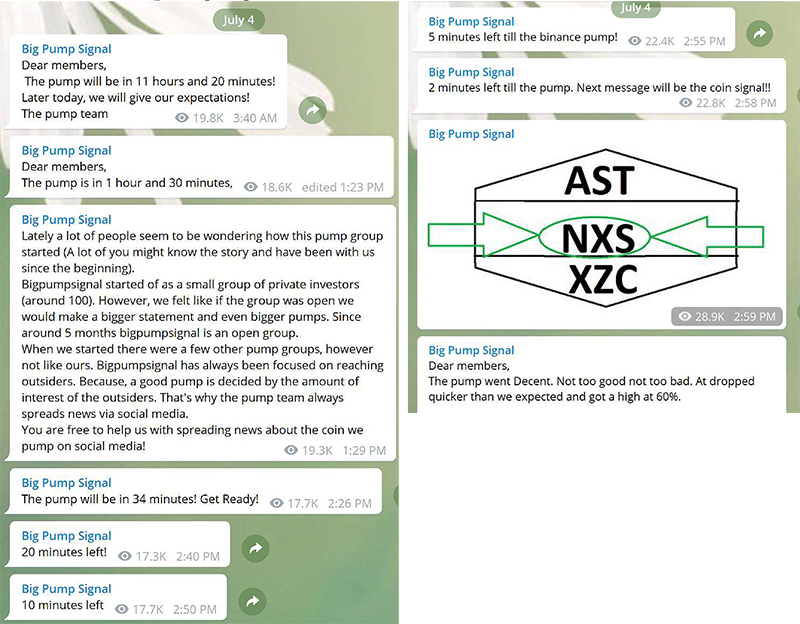

To orchestrate a price inflation, an operator announces the target date, time and exchange to the pump group. This information is usually communicated at least one day in advance, without revealing the identity of the target token. Then, just before the planned inflation, group members receive the token’s symbol, and the P&D begins.

Panel A displays a series of Telegram announcements by Big Pump Signal, one of the biggest pump groups, regarding their July 4, 2018 pump targeting Nexus (NXS). Panel B plots Nexus’s prices and volumes before and after the pump announcement (t =0).

Panel A: Telegram pump announcements on Nexus

How are cryptocurrency P&Ds different from those in the stock market?

P&D schemes can last for months in the stock market, but typically last only a few minutes in the cryptocurrency market. This makes it almost impossible for those not in the pump group to participate. Stock market P&Ds also usually involve some type of false information or action, while this is rare in cryptocurrency P&Ds. It is also easier to identify cryptocurrency P&Ds, because they are advertised on social media.

Although P&Ds are illegal in the stock market, there is little regulation of P&Ds in the cryptocurrency market. One reason for this is that most tokens are difficult to classify as investment or consumer products, so they don’t clearly fall under existing securities or consumer protection laws. Regulating cryptocurrencies also requires more global coordination than with other assets because tokens are usually traded globally.

Latest findings

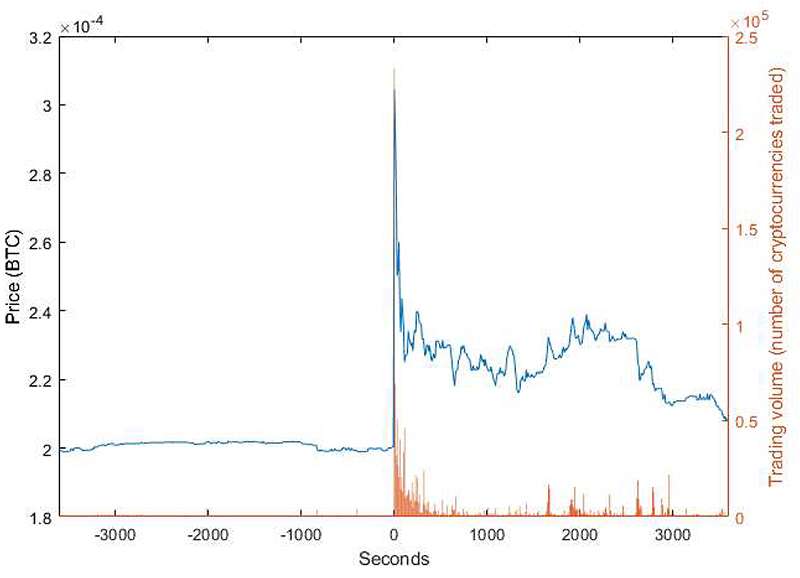

In a new study, researchers from the Kenan Institute of Private Enterprise examined 500 cryptocurrency P&D schemes to better understand their timing, characteristics and impacts. The authors found that P&Ds dramatically affect prices and volumes for pumped tokens in a very short time period. By just 70 seconds after the start of a P&D, token price increases by an average of 25 percent, trading volume increases almost 150 times, and the average 10-second absolute return reaches 15 percent. This is followed by an extremely quick reversal that leads to the disappearance of most value gains within an hour.

The authors observed that prices and the volume of pumped tokens begin to rise five minutes before a P&D starts. This likely occurs because pump group organizers can buy the pumped tokens in advance and some pump group organizers offer premium memberships that let a select group of investors receive pump signals before others. Insiders who buy in advance can benefit from returns as high as 18 percent, approximately one-third of a token’s daily trading volume during normal trading.

The research revealed that the only investors who profit are those who buy in the first 20 seconds after a P&D begins, on average. To profit, investors must dump their tokens very quickly. For example, an investor who buys tokens 10-20 seconds after the P&D starts and begins selling one minute later will lose 0.72 percent of his investment, on average. Overall, the researchers found evidence that significant wealth is transferred from those who don’t know about the P&D to those with insider knowledge.

Would a ban work?

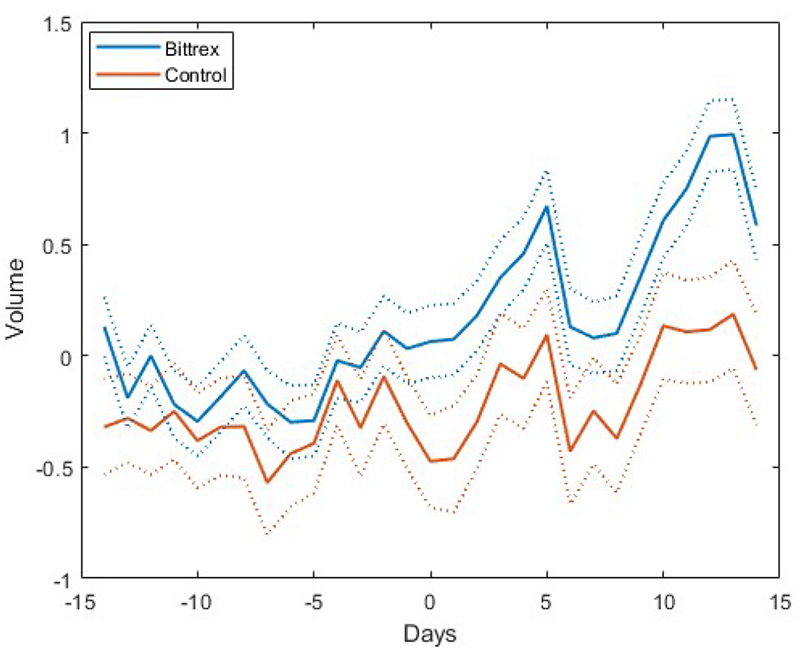

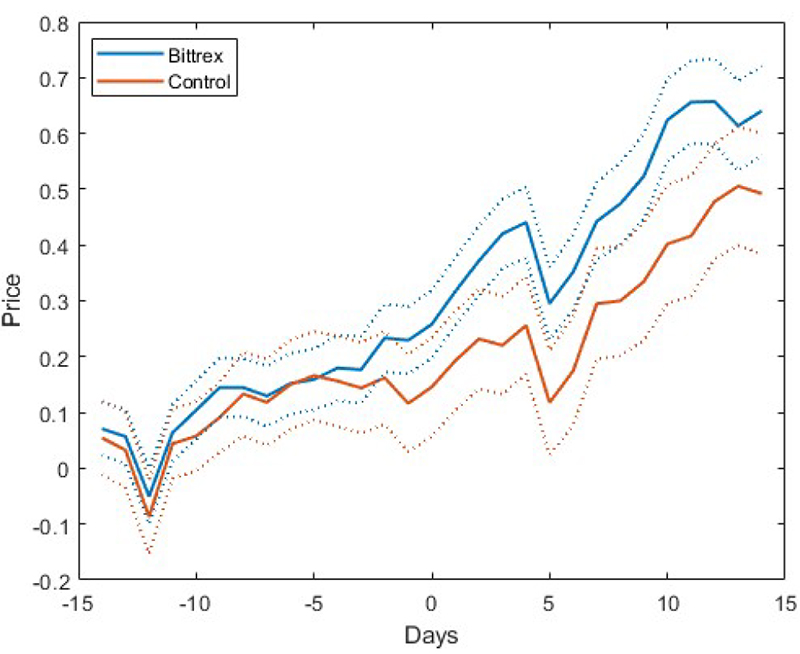

On November 24, 2017, the U.S.-based cryptocurrency exchange Bittrex announced a ban on P&Ds for tokens traded on its exchange. To study the impacts of this move, researchers matched 190 tokens listed on Bittrex at the time of the ban with tokens that had similar trading volumes listed on other exchanges. Following these tokens from 14 days before the ban to 30 days after revealed that the volumes and prices of tokens traded on Bittrex increased compared to the matched tokens on other exchanges that didn’t have P&D bans.

The researchers also observed that many scheduled P&D events were immediately canceled when the ban was announced. They estimate that the ban increased token prices by about 10.8 percent and volumes by almost 21.2 percent after seven days of the ban, compared to prices and volumes seven days before the ban, evidence that P&Ds reduce investors’ willingness to invest in the cryptocurrency market.

Based on their findings, the authors conclude that P&Ds should be regulated, though this could be challenging since cryptocurrencies fall outside of many existing legal frameworks and are traded globally. However, the outcomes of the Bittrex ban show that P&Ds hurt the health of the cryptocurrency market while also demonstrate the feasibility of banning P&Ds.

This figure displays volumes (Panel A) and prices (Panel B) of Bittrex cryptocurrencies and the control cryptocurrencies. The treatment group comprises cryptocurrencies listed on Bittrex on November 24, 2017, and the control group includes the matched cryptocurrencies not listed on Bittrex at that time. The control sample is formed by matching each coin (token) listed on Bittrex to a non-Bittrex coin (token) with the closest propensity score, where the propensity score is estimated using trading volume over the period running from 60 days to 31 days before the ban, market capitalization 31 days before the ban, cryptocurrency age, and past five-day return – the return during the five-day period before a pump event. The x-axis is the day relative to November 24, 2017. Volume is measured as the natural logarithm of the ratio between volume on day t and the average volume over the period from 60 days to 31 days before the ban. Price is defined as the natural logarithm of the ratio between the end-of-day price and the price at the end of day -31. Each point on the solid lines is the average across either the Bittrex cryptocurrencies or other control cryptocurrencies. The dashed line displays the 95% confidence intervals.

Panel A. Volume

Panel B. Price

- Keyword(s):

- cryptocurrency 17