In Search of Supply Chain Stability: Credit Where Credit’s Due

- Trade credit helps firms to hedge the risks involved in the departure of existing customers and the costly search for new customers.

- Consequently, firms that extend more trade credit have lower expected returns but longer expected relationships with their current customers.

- Investors that seek to lower risk should diversify their portfolios with high trade-credit firms, whose supply-chain environment is more resilient.

- Investors that seek long-term gains can create a long-short strategy that harvests the risk premium associated with bearing supply-chain disruption risk.

Supplier-Customer Relationships During COVID

The COVID-19 pandemic made the fragility of global supply chains big news. Plant shutdowns, port backlogs, increased freight costs and shipment restrictions resulted in shortages of goods and historically high inflation. Many supplier-customer relationships between firms were broken or at the very least compromised. Supply chain disruptions became so prevalent that they imposed a threat to economic and financial stability. The disrupted flow of goods across supply chain links has contributed to the sharp surge in the prices of food, fuel and materials over the last two years. Equity investors wishing to navigate the storm should seek to invest in firms with more resilient supply chains. But is there a reliable way to identify, in real time, firms whose supplier-customer relationships are less vulnerable to disruptions?

A recent paper by finance professors Gill Segal and Yunzhi Hu (UNC Kenan-Flager Business School) and Fotis Grigoris (Indiana University Kelley School of Business), which is forthcoming at the Review of Financial Studies, offers a straightforward answer: look at trade credit. Their study points to strong relationships between trade credit, the resilience of supplier-customer links in the production networks and stock returns.

What Trade Credit Can Tell Us

Let’s start by laying out the basic facts before explaining how to strategize these for investors. Firms maintain relationships (also referred to as “links”) with their customers. Each link can be characterized by two key properties: the duration of the link, measured by how long it lasts (the median is about three years), and the flow of trade, measured by sales. When firms sell goods to their customers, they typically demand a cash payment only for a fraction of the sale. The rest is financed using trade credit provided by the seller. Customers are expected to pay the remaining balance at an agreed-upon date (generally 30-90 days later), with no interest for on-time payment. This credit is logged under accounts receivables on the seller’s balance sheet. The amount of credit is sizable, accounting for about 20% of all sales. What is truly interesting is the information about firms’ risk and the fragility of their relationships with customers, which can be easily inferred from trade credit data.

The first stylized fact is that trade credit is informative about each firm’s risk profile. The research shows that firms that extend more trade credit, and have higher ratios of receivables to sales (R/S), earn significantly lower average returns. The spread in stock returns between low and high R/S firms, which can be used as a trading signal by investors, is about 0.6% a month, or 7.6% a year. The study refers to this spread as the “counterparty factor.”

But this finding creates a puzzle when we consider the typical risk-return trade-off in capital markets: Shouldn’t firms that extend more trade credit expose themselves to greater default risk from customers? If so, wouldn’t these high R/S firms be rewarded with higher average returns, not lower returns?

Not necessarily. The provision of trade credit should clearly depend on the quality of each firm’s customers and its standing relationship with them. Indeed, the second stylized fact is that trade credit is also informative about the stability of linkages in the production network. At the firm level, firms that extend more trade credit, or have high R/S, are less vulnerable to supply-chain disruptions; they maintain longer relationships with their customers going forward. Empirical analysis shows that a 1 standard deviation increase in R/S – that is, more provision of trade credit – increases the duration of any existing relationship the firm has with its customers by about four months and lowers the probability of these links breaking in the future by about 9%. Moreover, at the macro level, when the total amount of trade credit increases, the production network as a whole becomes denser – meaning that it features more interfirm linkages.

Hedging Customer Replacement

Are the former two facts related? Yes, according to the research of Segal, Grigoris and Hu. They test predictions from a model that connects these facts and reconciles why firms that extend less trade credit are riskier: Trade credit acts as a hedge against the costly search for new customers.

Here’s what it means in simple terms: Searching for new customers is a costly and risky process. Companies must consider the time, money and effort that goes into establishing a large and loyal customer base. In fact, trade credit can serve as a de facto insurance policy against this search risk. Trade credit induces high-quality customers to keep their relations with the firm. Why? By offering more trade credit to a better customer, the firm effectively sells its product at an effective discount, because repayments of trade credit are delayed. Consequently, higher trade credit raises the likelihood of retaining the customer and decreases the exposure to risks associated with its replacement. This explains why firms that provide more trade credit have lower expected returns, despite a greater default risk from customers, while having longer duration relationships with their customers.

This economic narrative has substantial support in the data. First, the dividends and profit margins are significantly lower for firms that recently matched with new customers, consistent with the idea that replacing customers is costly. Second, firms that extend more trade credit have better-quality customers, which are worth retaining, as proxied by measures of productivity. Last, suppliers that maintain shorter duration links with their customers indeed look riskier to investors because they earn average returns that are much higher (about 1% per month!) than those earned by suppliers that maintain longer duration links.

COVID-19 Disruptions and Trade Credit Factor

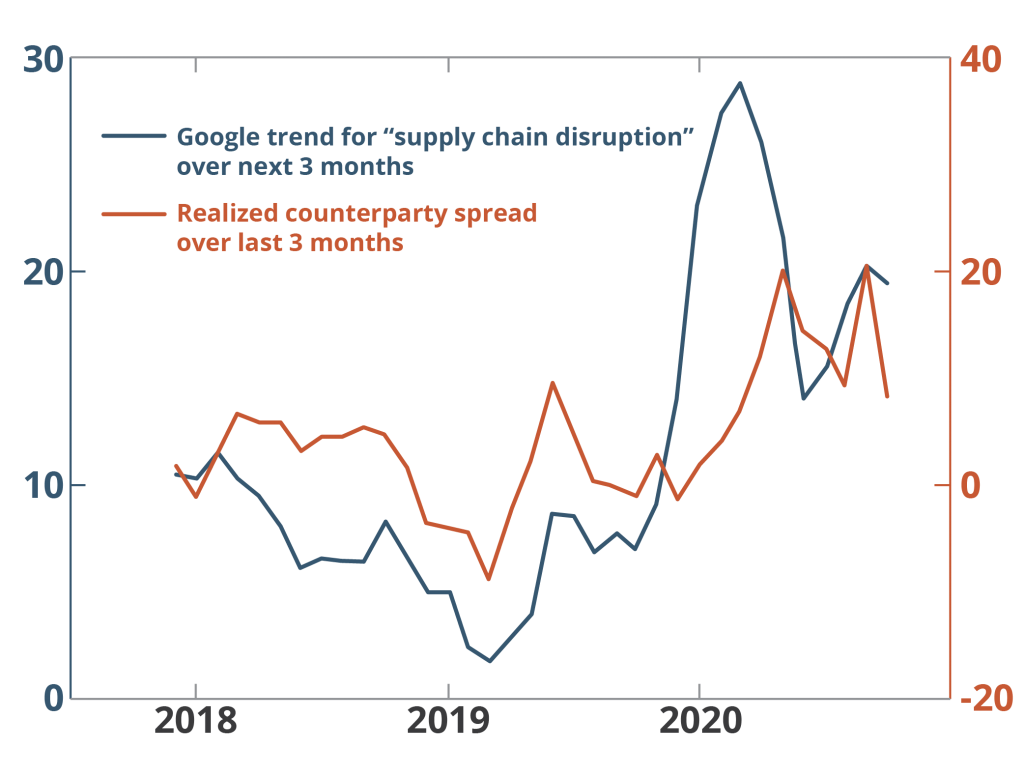

Beyond these long-run historical patterns, it’s interesting to consider how the relevance of supply chain disruptions around the COVID-19 crisis was predicted by the counterparty return spread. The following figure demonstrates how these lead-lag dynamics played out in real time.

The orange line shows the realized return on the counterparty risk factor over the last three months. The blue line shows the Google Trend score for the term “supply chain disruption” over the next three months. The predictive correlation between the two is quite striking, at about 0.6.

Investment and Managerial Implications

We can now harness the strong connection between trade credit and supply chain resilience, and use it to help mitigate the instability in the current environment.

For short-term investors, diversifying portfolios by selecting firms that offer more trade credit is a pretty good bet. Based on historical data, these are often firms with better-quality customers, whose linkages with customers are more likely than not to withstand short-term turmoil. In the short run, these high R/S firms can be viewed as a “safer haven,” when compared with other equities. Their valuation could be less adversely affected by the (potential) arrival of bad news about global trade flows and aggregate production network disruptions.

Long-term investors, who are willing to be more contrarian, can actually follow the strategy of the study: buy low R/S firms and short-sell high R/S firms. This strategy harvests the counterparty risk premium. It is expected to yield a sizable annual spread over long horizons, as compensation for bearing the customer disruption and turnover risk. To be clear, this strategy is a separate factor from other well-known risk factors – it produces an excess return (aka alpha) of about 0.6-0.9% per month.

Corporate managers can use this insight to stabilize supplier-customer links by offering more trade credit. Of course, a trade-off exists between default risk and customer replacement risk. However, the supply chain disruptions have proved that the costs of customer search these days are higher than normal. All else equal, this should push firms to extend a greater amount of credit than they traditionally would.